The prospects for tax reform and what a successful plan might ultimately look like were the topics of discussion Tuesday night at the American Council for Capital Formation’s March economic policy evening.

President Trump has vowed to take up comprehensive tax reform after efforts to repeal the Affordable Care Act failed in the House, but questions on how to proceed and whether Republicans will rally behind the current proposal remain unanswered.

Changes to the U.S. tax system to reduce the overall rates and encourage greater investment is long overdue. It has long been the position of the ACCF that meaningful tax reform will require bipartisan and bicameral support. The March 28 dinner was one of the several events the ACCF continues to host to promote agreement and compromise around responsible tax reform and economic policy.

House Republicans have put forward a blueprint for tax reform that seeks to significantly reduce the corporate tax rate in an effort to spur investment and job creation. Senate Republicans, however, have signaled opposition to the plan’s proposal to collect a tax on goods coming into the country and the business community is similarly divided over the border adjustability issue.

The border adjustability provision is central to paying for the tax rate reductions contained in the House blueprint, though, and conservative budget hawks have long opposed adding to the national debt – even to pay for a tax cut. Some Republicans have begun to signal a willingness to allow for increases in the deficit in the short term, though, if it results in greater economic growth in the long run.

There are a number of potential obstacles to moving comprehensive reform through Congress that are unrelated to the actual substantive debate about tax policy. The latest is Senate Majority Leader Mitch McConnell’s (R-Ky.) promise to hold a vote on Supreme Court justice nominee Neil Gorsuch before the Easter recess, which could further widen the partisan divide should Republicans invoke the nuclear option and change the rules to eliminate the filibuster for Supreme Court nominees.

Another rock hiding beneath the water is the potential for the tax debate to spark skirmishes over social issues between conservatives and Democrats and moderate Republicans. The GOP leadership will have to navigate attempts to defund Planned Parenthood and other controversial issues carefully to keep tax reform on the rails.

Complicating matters further is the need to pass legislation to fund the government beyond April 28 or risk a government shutdown. History has shown that neither party wins if the government shuts down but Democrats, feeling a resurgence of power after the collapse of health care repeal, may push their advantage to either win concessions from Republicans or, at the very least, try to wound them ahead of the 2018 midterms.

Oh, have we mentioned that Republicans in the Senate have yet to indicate what kind of tax reform package they would support?

Republicans hold 237 seats in the House and 52 seats in the Senate, but while that gives the GOP control of both chambers it doesn’t guarantee agreement. At the moment, Republicans are a fractious bunch.

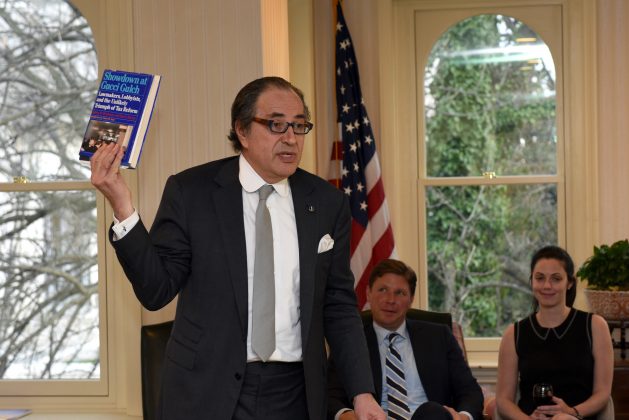

The last time Congress passed major tax reform was 1986. Key to that achievement was bipartisan agreement on the need for reform and broad public support. Thirty years later, the situation is much changed. Leaders of both political parties talk about the importance of tax reform, but they seem to be working off of very different talking points.

And, so far, little attention has been paid to the American voter.

Discussion around tax reform has focused on reducing the tax rate on businesses, with little talk about the individual tax rate. The reason for this is simple – the vast majority of the benefits to the overall U.S. economy of reducing the tax burden comes from cutting business taxes. Companies are much more likely to make the most meaningful investments in the U.S. economy, driving job creation and wage growth.

But has anyone told voters? Tax reform is somewhat like energy prices. The average American doesn’t pay much attention to the West Texas Intermediate price of a barrel of crude oil, but a 5-cent increase in the price of a gallon of gasoline is sure to get his or her attention.

Corporate tax reform may offer the greatest promise for an economic stimulus – with the widest possible benefits to the U.S. economy – but in the world of kitchen table economics, the American voter who is trying to balance the family budget has yet to be convinced.

For the president and Congress to succeed in reforming the nation’s tax system, voters must be persuaded that there’s some direct benefit in it for them.

Republicans have pointed to the example of President Ronald Reagan and the 1986 tax reform, but Reagan had the American people behind him. It remains to be seen whether President Trump or Republicans in Congress can capture that same support.

The ACCF has been a leader in the debate on tax policy for the past 30 years. Tuesday night was the organization’s 223rd policy salon, a Washington tradition that seeks to promote a bipartisan approach to economic policies by bringing together members of Congress with business leaders, academics, and senior members of the media.

Participants included members of Congress, as well as economists Stephen Moore, a senior economic advisor to President Trump; and Bill Gale, co-director of the Brookings Institution and Urban Institute Tax Policy Center; Alan Murray, editor-in-chief of Fortune Magazine, and ACCF’s own chief economist, Pinar Cebi Wilber.