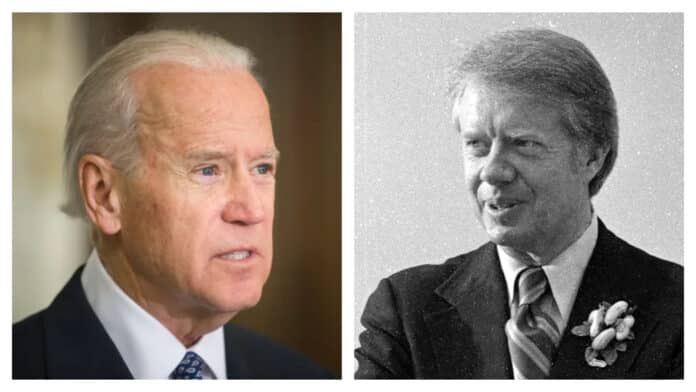

To say that history is repeating itself is an understatement when it comes to tax policy. In his budget to Congress, President Biden proposed nearly doubling the capital gains tax from 20 percent to 39.6 percent “to ensure that the wealthy pay their fair share.”

It’s eerily reminiscent of another Democratic president 45 years ago. Also in the midst of a sluggish economy held back by stubborn inflation, President Carter’s “tax reform” package included a dramatic increase in the federal capital gains tax to prevent “huge tax windfalls for millionaires.”

Carter met resistance from a bold group of lawmakers led by Rep. William Steiger (R-Wis.), who offered a counterproposal: “Instead of increasing the tax, let’s reduce it.” Steiger won.

Now, here we go again with President Biden’s big hike on the capital gains tax.

The lessons of the Steiger victory are three-fold.

A commitment to bipartisanship was critical. Steiger and Sen. Clifford Hansen (R-Wyo.), worked closely with their Democratic allies, especially Sen. Alan Cranston (D-Calif.)

And Sen. Russell Long (D-La.), the powerful chairman of the Senate Finance Committee.

To serve the Steiger-Hansen goals but not bear the GOP label, Chairman Long suggested resurrecting President Kennedy’s proposed 1963 capital gains tax reform to increase the exclusion of capital gains from ordinary income from 50 percent to 70 percent, benefitting not just the wealthy but all taxpayers.

Capital gains revenue is uniquely determined by the “lock-in effect.” If the tax rate is too high, investors hold onto their assets. If the tax is low enough, investors have an incentive to sell assets, realize capital gains and the Treasury benefits.

New York investor Oscar Pollock and I have studied the lock-in effect. After the 1978 capital gains tax cut, revenue increased, not decreased. In 2003, the maximum capital gains dropped to 15 percent, from 20 percent. According to the Congressional Budget Office, capital gains tax receipts by 2005-06, at an average of $98 billion a year, were up 81 percent and reached a new peak of $127 billion in 2007 with a maximum rate still at 15 percent. Oscar and I suggest the ideal capital gains tax rate is 15 percent.

The capital gains tax has a powerful impact on venture capital, innovation and entrepreneurship. In 1978, Ed Zschau, CEO of a Silicon Valley high-tech startup, released the results of a survey to Congress, which demonstrated that the doubling of capital gains tax rates between 1969 and 1976 all but wiped-out venture capital in the tech industry.

Ken Hagerty of the Western Electronics Association and the National Venture Capital Association provided real live stories. In the book “The Power Law: Venture Capital and the Making of the New Future,” Sebastian Mallaby writes that the big 1978 capital gains tax reduction greatly increased investment in venture capital.

The capital gains tax stimulates job creation and economic growth. Early in the Steiger story, economist Richard Rahn worked with a wide range of economists to forecast the “dynamic,” not “static,” impact of a capital gains tax cut. It would greatly stimulate new jobs and new businesses, entrepreneurship and productivity.

Sen. Long provided testimonials in support of a capital gains tax cut from some 35 academic experts, former government officials and all living former Treasury secretaries.

There are two footnotes to the story.

In a 1979 message to Congress, President Carter wrote, “I understand and fully appreciate that changing certain of our tax laws could provide additional incentive for investment and innovation. Indeed, my approval of adjustments to the capital gains tax in The Revenue Act of 1978 has alleviated some shortages of venture capital.”

Years ago, Ed Zschau and I roamed the halls of Congress with a shopping cart full of his track, “The Old Risk Capital Blues.” Maybe it’s time to put it on YouTube. After all, YouTube began as a venture capital-funded technology start-up in 2005, when the capital gains tax rate was a mere 15 percent.

Mark Bloomfield is president and CEO of the American Council for Capital Formation. He is considered an architect of the 1978 capital gains tax cut.