The Congressional Budget Office (CBO) recently released its updated outlook for the finances of the federal government. CBO projects that the deficit will rise to historically unprecedented levels for the United States, even compared with our worst recessions and following World War II, and are beginning to approach the troubled finances of countries such as Italy and Portugal.

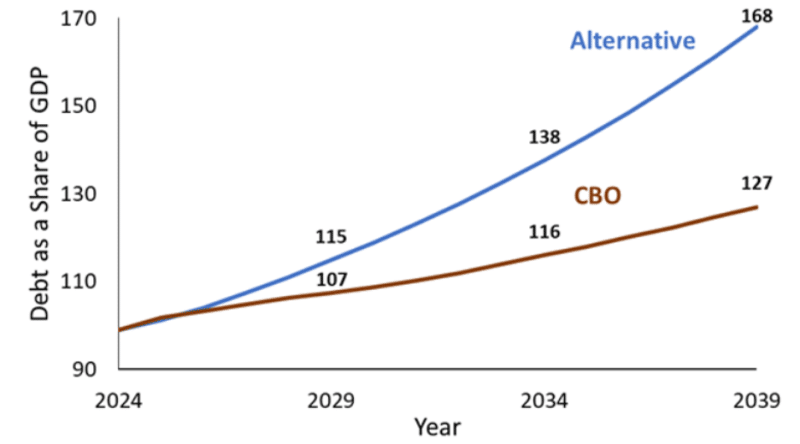

The projection forecasts the deficit will grow from 5.6 percent of GDP in 2024 to 6.1 percent in 2034 then to 6.9 percent in 2039, and that debt held by the public will increase from 99 percent of GDP, to 116 percent, then to 127 percent in the same years. To make matters worse, underlying the CBO projections is an optimistic view that, as a share of GDP, federal government spending will be somewhat contained, revenues will rise, and interest rates will fall.

What would it look like if these favorable (and arguably unrealistic) conditions did not occur? What if we instead saw a continuation of current trends and historical economic relationships? The model below (calculated by the author and represented by the blue line) projects the next 15 years of government finances and finds much more sobering and concerning results, moving forward significantly the expected time of needed fiscal reckoning:

Figure 1. Projected U.S. Federal Debt as a Share of GDP, 2024-2039. Source: CBO (2024); Author’s Calculations.

National Review Plus subscribers can read the full piece here.